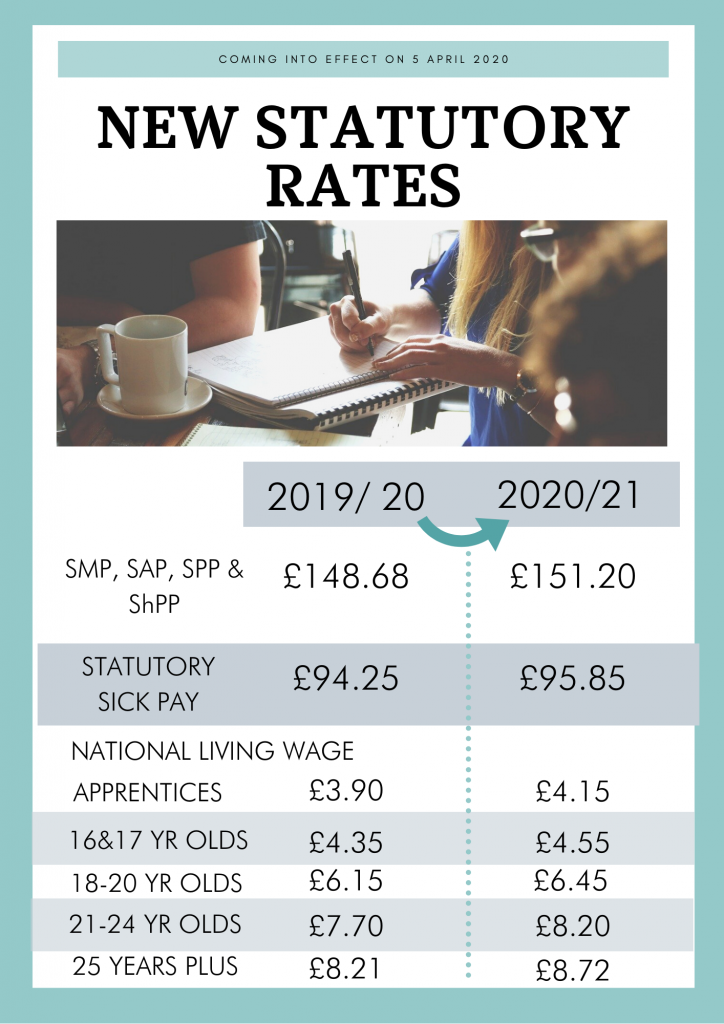

The Government has published the proposed statutory rates for Statutory Maternity Pay (SMP), Statutory Paternity Pay (SPP), Shared Parental Pay (ShPP) and Statutory Adoption Pay (SAP), which come into effect on 5 April 2020, the first Sunday in April. The amount of the earnings threshold (currently £118.00 per week) for tax year 2020/21, below which employees are not entitled to SMP, SAP, SPP, ShPP and SSP, is yet to be confirmed.